Investing in climate-resilient infrastructure

Published on August 19th, 2024

Roads, bridges, water mains, sewers, and storm drainages built between the 1950s and early 2000s were not engineered to withstand today’s challenges. As we see an increase of floods, storms, and wildfires around the world, it is critical for municipalities to invest in climate-resilient infrastructure.

Table of Contents

The case for financing climate adaptation

According to estimates by the the Canada Climate Institute, Canada is expected to experience $25 billion in annual Gross Domestic Product losses due to climate change in 2025. By 2050, this estimate rises to between $78 billion and $101 billion per year. And major reason for those losses is due to the fact our current infrastructure is not climate-resilient.

Flooding can wash out highways and bridges, disrupt transportation networks, and lead to significant delays and costs in trade. Wildfires can destroy power lines, communication systems, and water supplies, leading to prolonged outages and costly repairs. Storms can damage buildings, ports, and other facilities essential for economic activity.

Investing in climate-resilient infrastructure is essential to mitigate these impacts. This includes designing and constructing buildings and infrastructure that can withstand extreme weather conditions, improving drainage systems to handle increased rainfall, and reinforcing electrical grids to prevent outages during storms. Such investments not only reduce the immediate costs of repairs and replacements but also ensure the safety of communities and the continuity of economic activities.

Although it may seem costly to invest in climate-resilient infrastructure now, the cost will only go up. Looking at the issue long-term reveals that proactive investments today can prevent far greater expenses, losses, and risks in the near future.

Financing climate-resilient infrastructure

Despite the benefits of investing in climate resilient-infrastructure, securing the funds to build new and adapt existing climate-ready assets is no simple feat.

Climate adaptation funds are significantly limited, with only 7% of climate funding dedicated to adaptation efforts globally.

This is particularly challenging for Canadian municipalities, who are on the front lines of climate change.

Canadian municipalities own and operate roughly 60% of Canada’s public infrastructure. As a result, they are the ones responsible for making multi-billion adaptation investments with very restricted revenue sources.

Municipalities can finance climate-resilient infrastructure in one of four ways:

Government grants and funding

Securing federal and provincial government grants specifically allocated for climate resilience projects, like the Green Municipal Fund. These grants can provide significant financial support for large-scale infrastructure upgrades and new constructions.

Municipal bonds

Issuing municipal bonds to raise capital for infrastructure projects. Bonds allow municipalities to borrow money from investors with the promise of repayment with interest over time. This approach can provide the necessary upfront funds for large investments.

Local taxes and fees

Implementing or increasing local taxes, such as property taxes, and user fees, such as tolls or service charges, to generate revenue for infrastructure improvements. While an effective way to raise funds for climate-resilient infrastructure projects, it can also be a political risk.

Public-private partnerships

Engaging in partnerships with private sector entities to share the costs and risks associated with infrastructure projects. PPPs can leverage private investment and expertise while ensuring public benefits.https://www.youtube.com/watch?v=42v5eRBX3Ig

Regardless of where the funds come from, municipalities will need to demonstrate the long-term benefits of their investment.

Showcasing how invest in climate-resilient infrastructure future repairs, replacements, minimize service disruption, product public safety, and enhance overall community and economic well-being is critical.

By providing a clear, long-term vision of the advantages, municipalities may just secure the necessary support and resources to make these critical investments.

Demonstrating the benefits of climate-resilient infrastructure with Asset Investment Planning (AIP)

Investments in climate-resilient infrastructure must overcome the initial sticker shock by clearly communicating the long-term value.

And because humans are naturally wired to prioritize immediate rewards and concerns over distant benefits, demonstrating the long-term value is an uphill battle. Without the right tools.

To clearly demonstrate the benefit of any long-term investment, asset-intensive organizations like municipalities should turn to an Asset Investment Planning (AIP) solution.

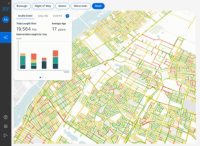

AIP software leverage asset data and decision-making processes to predict the current and future performance of assets long-term. Combining the asset’s future performance with financial, risk, and regulatory data, an AIP simulates various investment scenarios, demonstrating the benefits and trade-offs, enabling users to determine the optimal path forward to achieve and sustain their strategic goals.

What is Asset Investment Planning?

A full guide on how Asset Investment Planning works and the benefits it offers asset-intensive organizations.

Click Here

Asset Investment Planning software, designed to analyze benefits and trade-offs over up to 100 years, can effectively highlight the advantages of investing in climate-resilient infrastructure while also identifying optimal allocations despite the investment constraints municipalities face.

The status quo investment scenario

The first investment scenario municipalities should create with AIP to demonstrate the importance of climate-resilient infrastructure is a status quo or “climate baseline scenario.”

In this scenario, municipalities take:

– Their actual asset data

– Their actual budgets

– Climate data to account for the higher frequency of severe weather events

If climate data is not available, this can be represented with higher rates of degradation and asset failure risk within the asset model.

In doing so, municipalities can simulate to demonstrate the long-term cost of failing to adapt.

They may find that, with the current assets and budget constraints, replacement requirements and costs triple over the next thirty years, surpassing the city’s risk threshold and making it nearly impossible to deliver the desired levels of service.

Climate-resilient scenarios

Once a municipality clearly demonstrates the long-term cost and risk of the status quo scenario, they can then test the benefits of adding climate-resilient assets to their portfolios.

For example, a municipality can test the performance of investing in upgrades of their stormwater infrastructure.

By creating asset models of the upgrades available, they can simulate and test the impact of:

– Increased capacity during extreme rainfall

– Changes in expected break rates

– Which segments to prioritize

In addition to stormwater upgrades, the municipality can also test improvements to other water infrastructure and roadwork to ensure they align with the stormwater enhancements.

In other words, replacing stormwater infrastructure with assets of larger diameter, relining potable water pipes, and rebuilding roads with more durable materials may cost the municipality 10% more in the short term but could save billions in repairs over the next 30 years.

Meanwhile, simply replacing the stormwater infrastructure and using more durable materials for roadwork may be riskier long-term, but the city will only need to invest 6% more per year.

Both scenarios reduce risk and save money long-term. Ultimately, what it comes down to is what the municipality can afford to do with the funds available to them.

Funding scenarios

Besides demonstrating the risks of maintaining the status quo and quantifying the impact of climate-resilient investments, municipalities can use AIP to create scenarios based on their available funds.

For example, because raising property taxes carries political risks, municipalities can evaluate how much they can invest in climate-resilient infrastructure with or without increasing property taxes, and understand the long-term benefits and trade-offs of different tax levels.

Additionally, municipalities can build investment scenarios based on whether they receive federal or provincial funding versus having to fund the projects themselves.

By assessing these scenarios and planning for contingencies, municipalities can find flexible ways to invest in climate-resilient infrastructure with whatever resources they have available.

Planning for the future with AIP

Climate change is increasingly affecting the lives of Canadians. The costs of the damage caused by extreme weather events like floods and wildfires are increasing.

And though we’ve all felt the impacts, investing in climate-resilient infrastructure remains an uphill battle for municipalities.

Thankfully, the Direxyon Asset Investment Planning (AIP) solution allows municipalities to simulate and compare the most impact ways to invest in climate-resilient infrastructure.

By leveraging AIP, municipalities can navigate the complexities of funding and investment options, balance political and financial constraints, and make data-driven decisions that enhance their resilience long-term.

To learn more about how Direxyon can help your municipality become more climate resilient, contact us today.

Municipalities we serve

Let us show you how it works

Our product specialists will walk you through our proven approach to enhance your capital investment planning.

Explore resources

-

News

NewsDIREXYON Launches GO, an AI-Powered Platform to Streamline Strategic Infrastructure Investments

Read more : DIREXYON Launches GO, an AI-Powered Platform to Streamline Strategic Infrastructure InvestmentsSelf-serve Digital Twin delivers clarity to strategic infrastructure decisions Montreal, QC, September 18, 2025 – DIREXYON Technologies today announced the launch of DIREXYON GO, a self-serve platform that simplifies and accelerates Asset Investment Planning (AIP) for municipalities and utilities. DIREXYON…

-

E-book

E-bookTurning Wildfire Data into Smarter Investments

Read more : Turning Wildfire Data into Smarter InvestmentsYour wildfire data can do more than predict where fires may spread. It can guide the decisions that protect your grid and your communities. Wildfire threats are rising, regulations are tightening, and budgets are stretched thin. Utilities need more than…

-

Blog

BlogWhat is Strategic Asset Management?

Read more : What is Strategic Asset Management?Strategic Asset Management is more than a buzzword. It’s a transformative shift in how municipalities and electric utilities manage infrastructure, budgets, and long-term risk. At its core, strategic asset management is about using data to make better decisions. Instead of…