How asset-centric simulation bridges the gap between data and decision

Published on July 22nd, 2025

Asset-intensive organizations have no shortage of data. Sensors, inspection logs, GIS platforms, and financial systems generate a continuous stream of information about infrastructure condition, usage, cost, and risk.

But having data isn’t the same as having answers to critical questions.

The real challenge lies in translating this raw data into actionable strategies that align with budgets, regulatory demands, and long-term performance goals.

And this is where asset-centric simulation comes in.

What is asset-centric simulation?

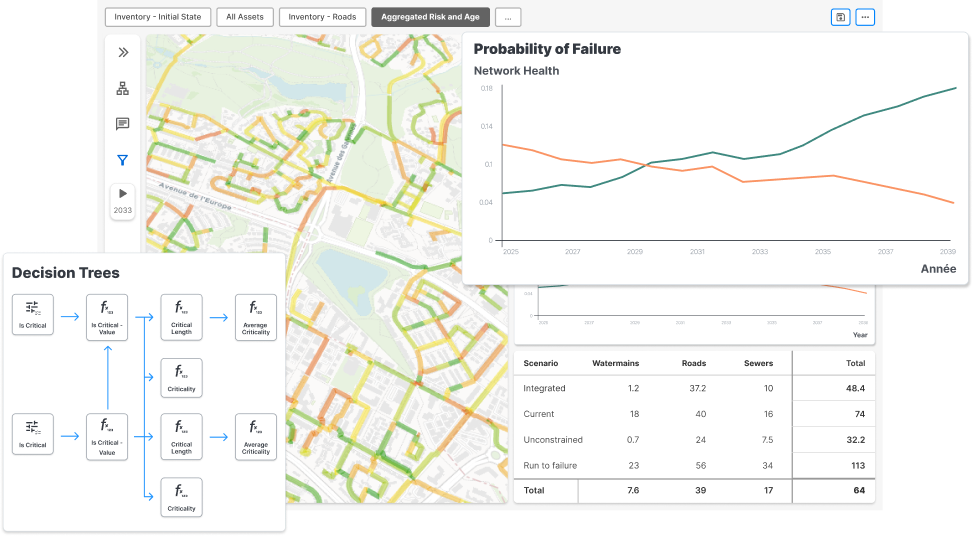

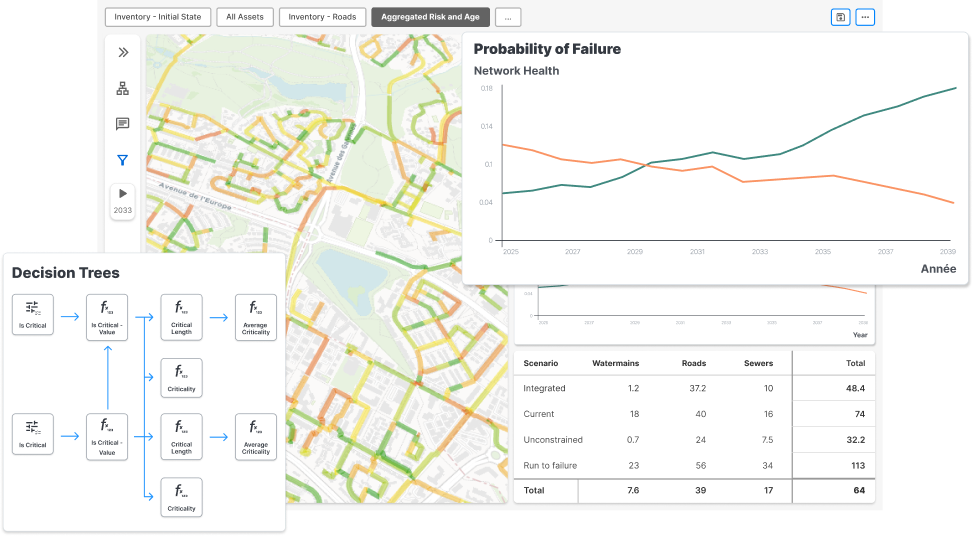

Asset-centric simulation is an approach to asset management and investment planning that focuses on the behavior, condition, and lifecycle of individual assets, rather than treating them as abstract budget line items.

Whereas traditional financial or strategic models operate at a high level and often simplify infrastructure into categories or averages, asset-centric models are built from the ground up. Each asset is represented based on its type, age, condition, usage pattern, and exposure to environmental and operational stresses.

An asset-centric simulation can then forecast how assets will degrade over time, how they respond to different maintenance strategies, and what outcomes are likely under varying investment levels.

The benefits of asset-centric simulation

Asset management and investment planning is rarely straightforward.

Decisions must balance technical realities, budget limitations, public expectations, and long-term risk.

That’s why the level of detail and foresight offered by asset-centric simulation is so important. It brings clarity to complexity and helps organizations make smarter, more justifiable choices.

Realistic modeling

Assets don’t age uniformly. Some roads degrade faster due to traffic volume; some transformers fail early due to heat exposure or deferred maintenance.

Asset-centric simulation reflects this variability, drawing on deterioration curves, historical data, and engineering models to create accurate, asset-by-asset forecasts.

The result: more realistic capital planning and fewer surprises.

Decision-aware

Every investment (or lack thereof) has long-term consequences. Asset-centric simulation doesn’t just model “what is,” but also “what if.”

What happens if you delay pole replacements by five years? What’s the trade-off between preventive maintenance and full rehabilitation?

By linking decisions to future outcomes, organizations can better prioritize and justify their actions.

Tied to funding and policy

Funding decisions aren’t made in a vacuum — they’re influenced by political priorities, climate goals, risk tolerance, and service level targets.

Asset-centric simulation integrates financial constraints and policy objectives into its projections. It helps planners evaluate not just whether an investment is technically sound, but whether it’s feasible, timely, and aligned with strategic goals.

Adopting an asset-centric approach

Discover how your organization can turn raw asset data into sustainable investment strategies.

Speak to an expert

Bridging the gap between assets and decision-making

Even with robust data systems in place, many organizations struggle to turn raw information into coordinated, forward-looking decisions.

Planning teams are often stuck in reactive cycles, making short-term fixes, justifying budgets, and juggling siloed priorities.

Asset-centric simulation acts as a connective layer, transforming scattered data points into strategic insight and aligning day-to-day operations with long-term goals.

From spreadsheets to strategy

Many organizations still rely on spreadsheets or fragmented tools to track asset condition and costs.

Asset-centric simulation consolidates these datasets and translates them into long-term, probablistic performance forecasts. This enables leaders to shift from reactive planning to long-term strategy.

From silos to integration

Traditionally, engineering teams, finance departments, and risk managers operate in silos.

Asset-centric simulation breaks down those barriers by integrating technical asset data with financial models and risk assessments. It provides a shared platform for cross-functional planning and collaboration.

From reactive to proactive

Waiting for assets to fail is costly and disruptive.

Simulation allows organizations to anticipate future failure points, test mitigation strategies, and prioritize the most cost-effective interventions. Over time, this leads to a more resilient, efficient, and financially sustainable infrastructure portfolio.

Bridging the gap between assets and decision-making

Data alone isn’t enough. To make informed, defensible, and forward-looking decisions, organizations need more than spreadsheets and intuition — they need tools that connect the dots between assets and outcomes, investments and impact, risk and resilience. That’s exactly what asset-centric simulation delivers.

By modeling infrastructure performance over time, it gives planners and decision-makers the clarity to move beyond short-term fixes and toward long-term value. It turns raw data into strategic foresight — helping you prioritize the right projects, justify funding, and build a more resilient future.

Ready to see how asset-centric simulation can transform your asset management and investment planning processes?

Discover a smarter, data-driven way to manage your infrastructure

Let us show you how it works

Our product specialists will walk you through our proven approach to enhance your capital investment planning.

Explore resources

-

News

NewsDIREXYON Launches GO, an AI-Powered Platform to Streamline Strategic Infrastructure Investments

Read more : DIREXYON Launches GO, an AI-Powered Platform to Streamline Strategic Infrastructure InvestmentsSelf-serve Digital Twin delivers clarity to strategic infrastructure decisions Montreal, QC, September 18, 2025 – DIREXYON Technologies today announced the launch of DIREXYON GO, a self-serve platform that simplifies and accelerates Asset Investment Planning (AIP) for municipalities and utilities. DIREXYON…

-

E-book

E-bookTurning Wildfire Data into Smarter Investments

Read more : Turning Wildfire Data into Smarter InvestmentsYour wildfire data can do more than predict where fires may spread. It can guide the decisions that protect your grid and your communities. Wildfire threats are rising, regulations are tightening, and budgets are stretched thin. Utilities need more than…

-

Blog

BlogWhat is Strategic Asset Management?

Read more : What is Strategic Asset Management?Strategic Asset Management is more than a buzzword. It’s a transformative shift in how municipalities and electric utilities manage infrastructure, budgets, and long-term risk. At its core, strategic asset management is about using data to make better decisions. Instead of…