Decision-making clarity for power utilities

DIREXYON’s AI-assisted Asset Investment Planning solutions empower utilities to simulate, plan, and optimize their investments, ensuring every decision supports resilience, reliability, and performance.

Planning for a changing energy landscape

Today’s grid wasn’t built for modern demands or emerging risks.

Utilities must modernize aging infrastructure, integrate renewables, and meet rising expectations for reliability, sustainability, and cost.

DIREXYON’s AI-powered simulations help you navigate these challenges—identifying the right balance between cost, risk, and performance with templated or fully configurable solutions.

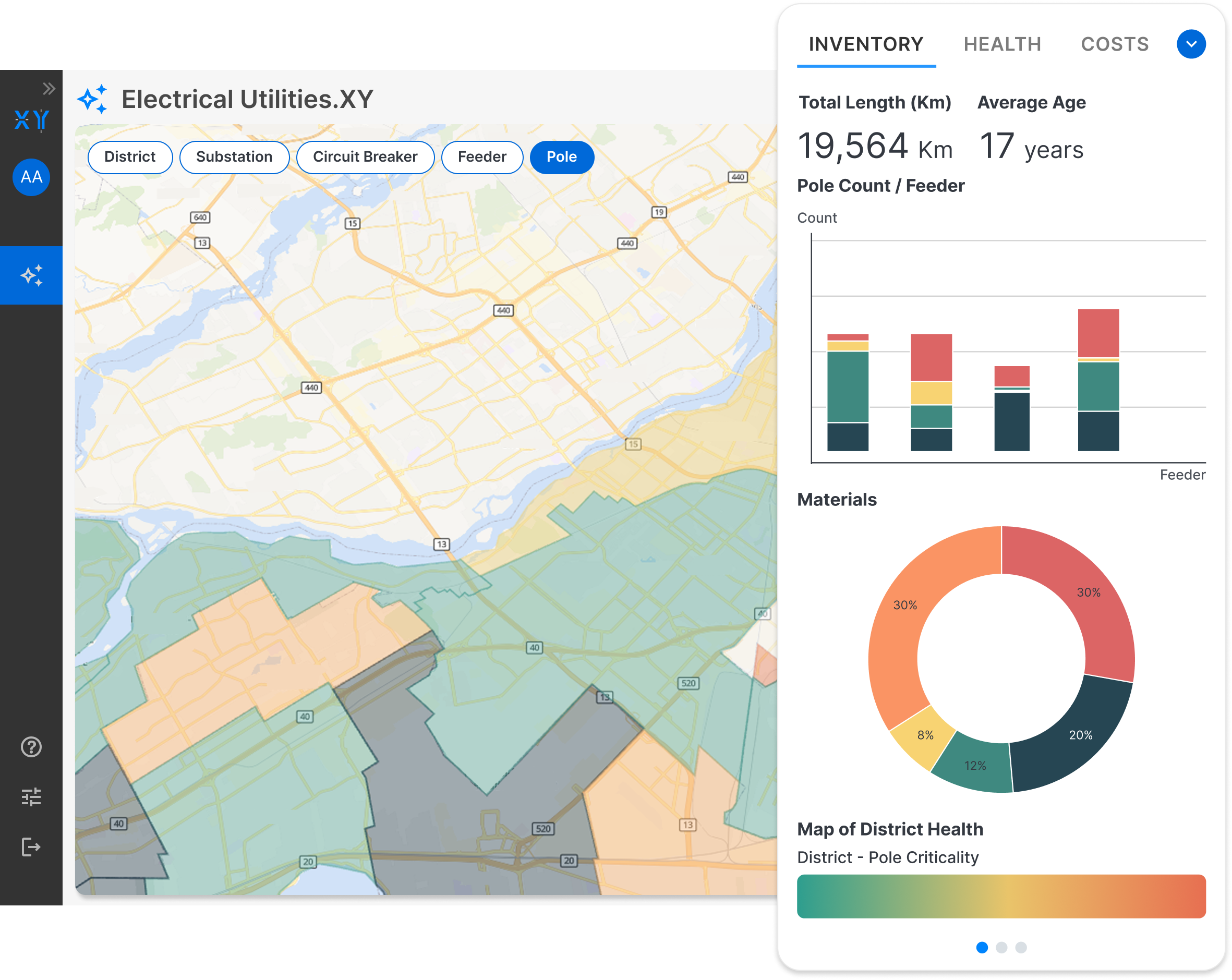

Investing in Reliable, Resilient Energy Infrastructure

Your investment decisions shape our future.

Whether you’re strengthening grid resilience, supporting EV rollouts, or expanding renewable integration, our templated or fully configurable platforms help you plan with precision.

DIREXYON lets you simulate the long-term impact of capital investments, maintenance strategies, grid modernization, and regulatory change using ready-to-deploy modules and AI-assisted planning to spend smarter, even when data is incomplete.

The Insight We Deliver

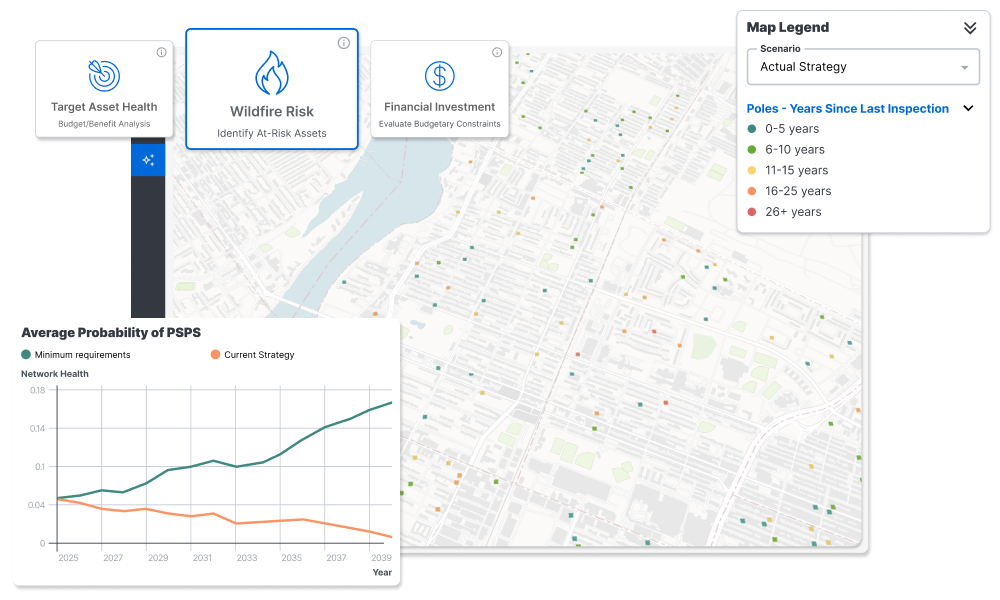

Wildfire Risk Mitigation

Target your service territory’s high-risk areas to reduce fire hazards and protect critical infrastructure.

Reducing PSPS Events

Simulate grid resilience strategies to minimize outages while maintaining safety and compliance.

Rate Case Justification

Build transparent, data-driven investment plans that regulators trust and stakeholders understand.

Getting Started

Resilient, reliable energy infrastructure begins with visibility.

There are so many ways to optimize an electric utility’s investment and asset management strategies, but too often they are limited by a lack of data, resource constraints, and disparate teams, systems, and tools.

With too many unknowns, decision-making stalls, and opportunities slip away.

If you need help unifying your data, filling in gaps with AI, and gaining the visibility to take the first step toward better performance, DIREXYON delivers purpose-built solutions that make your infrastructure clear and actionable.

Turning Insight into Impact

With DIREXYON’s AI-assisted simulation solutions, electric utilities unlock powerful results across key priorities:

Reduction in lifecycle costs

Reduction in deferred maintenance

Reduction in climate-related risks

Reduction in stranded capital

Trusted by

Let us show you how it works

Our product specialists will walk you through how you can enhance your decision-making.