What is integrated risk management?

Published on July 16th, 2024

Supply chain disruption, climate change, and inflation have emerged as central figures organizations must consider in the current landscape. While each risk can be quantified individually, their increasing interconnectedness presents organizations with new challenges to assess and mitigate them. To better protect against these interconnected risks, finance and risk professionals lean on integrated risk management to develop proactive, resilient strategies.

Table of Contents

Traditional vs. integrated risk management

Traditionally, individual activities or departmental silos manage risk.

By contrast, integrated risk management, also known as consolidated risk, uses a holistic framework to bring visibility to all risk and management activities across an organization.

For example, an electric utility can assess any risk’s impact on operations, level of service, finances, and regulatory compliance.

Rather than mitigating risk in isolation, the utility sees how much they invest in vegetation management and how it impacts their operational risk, wildfire risk, financial risk, etc.

Components of integrated risk management

First and foremost, this is no mere shift in mindset.

Breaking silos requires a continuous, proactive, and systematic process to understand, manage, and communicate risk to support consistent strategic decision-making.

The basic framework of integrated risk management is:

Risk identification

The first step for any organization is to create an inventory of all possible risks. The organization must account for everything from asset failure to failing to comply with regulations.

Risk assessment

Once identified, the organization assesses risks by their potential impact. Assessing the possible consequences, as well as any interdependencies, creates a clear hierarchy of priorities and determines where to allocate resources to mitigate the biggest threats.

Risk mitigation

Following the assessment, organizations develop strategies to mitigate the identified risks. This may include investing in new assets, more inspections, or implementing predictive maintenance strategies. It largely depends on the resources available, the risk tolerance, and the organization’s overarching strategic goals.

Continuous risk monitoring

Measuring the effectiveness of the chosen risk mitigation is crucial. Risk mitigation is a series of diminishing returns. For example, if the organization replaces every 40-year-old asset, continuing to replace the next oldest assets won’t have the same impact on the risk profile.

Continuously monitoring the effectiveness of risk mitigation across functions ensures organizations can quickly adapt and move on to emerging risk to maintain resiliency.

Although this high-level overview may seem simple, the truth is implementing an integrated risk management framework can itself become a risk if the organization does not support it with the right tools.

Asset Investment Planning and asset-centric integrated risk

With so many different integrated risk management platforms built to support HR and IT departments, finding one that can support the complexities of risk in asset-intensive organizations like electric utilities and municipalities can be a challenge.

But Asset Investment Planning (AIP) can be used to align investment decisions with risk mitigation strategies and resource allocations to build resilience and operational reliability long-term.

Asset Investment Planning is software used to optimize investment decisions and prioritize spending on critical assets thanks to predictive modeling simulating asset performance long-term.

When using Direxyon’s AIP solution, electric utilities and municipalities create an integrated risk framework by:

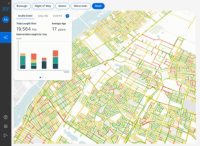

Consolidating asset data

Drawing asset data from any format, source, or vendor, the AIP solution serves a single source of truth for an asset-intensive organization. All condition and characteristic data can be found in a single place, revealing risk hierarchies and interdependencies across the portfolio.

With the asset data in place, predictive models are built to forecast asset performance, the probability of failure, the consequences of failure, and the overall risk of each asset.

Formalizing decision-making processes

To capture an organization’s policies, expertise and best practices, Direxyon AIP uses what is known as a “Decision Twin.”

The Decision Twin is a series of decision trees which combine perspectives and requirements from various departments. Building them formalizes the overall direction for integrated risk management by visualizing:

– The rationale for managing certain risks

– Links between risk and objectives

– Responsibilities for managing risk

– How resources are allocated to managing the various risks

Scenario modeling

With the data and decisions in place, organizations simulate to see how their current strategy impacts risk, finances, asset performance, regulatory compliance, etc. Following this initial simulation, they can then begin to test different strategies to compare the effectiveness.

For example, an electric utility may test the impact of investing more in vegetation management annually. They can test the impact of adding covered conductors or undergrounding certain high-risk segments.

By testing the various mitigation strategies available to them, they can find the optimal balance across their options. And they can continue to monitor the progress and quickly adapt when the current strategy begins to plateau.

Integrating your risk management

Integrated risk management is an essential approach for organizations seeking to navigate the complex risk landscape of today’s business world. By providing a holistic, proactive, and strategic framework, utilities are empowered to identify, assess, and mitigate risks effectively. This not only enhances resilience and decision-making but also supports regulatory compliance and overall organizational success.

As the business environment continues to evolve, adopting an AIP to facilitate an integrated risk management framework is crucial for organizations aiming to thrive in the face of uncertainty and change.

Integrated risk management

Find out how Direxyon can give your organization unparalleled visibility on the risks you face and the most effective way to mitigate them.

Book a Demo

Let us show you how it works

Our product specialists will walk you through our proven approach to enhance your capital investment planning.

Explore resources

-

News

NewsDIREXYON Launches GO, an AI-Powered Platform to Streamline Strategic Infrastructure Investments

Read more : DIREXYON Launches GO, an AI-Powered Platform to Streamline Strategic Infrastructure InvestmentsSelf-serve Digital Twin delivers clarity to strategic infrastructure decisions Montreal, QC, September 18, 2025 – DIREXYON Technologies today announced the launch of DIREXYON GO, a self-serve platform that simplifies and accelerates Asset Investment Planning (AIP) for municipalities and utilities. DIREXYON…

-

E-book

E-bookTurning Wildfire Data into Smarter Investments

Read more : Turning Wildfire Data into Smarter InvestmentsYour wildfire data can do more than predict where fires may spread. It can guide the decisions that protect your grid and your communities. Wildfire threats are rising, regulations are tightening, and budgets are stretched thin. Utilities need more than…

-

Blog

BlogWhat is Strategic Asset Management?

Read more : What is Strategic Asset Management?Strategic Asset Management is more than a buzzword. It’s a transformative shift in how municipalities and electric utilities manage infrastructure, budgets, and long-term risk. At its core, strategic asset management is about using data to make better decisions. Instead of…