Turning Wildfire Data into Smarter Investments

Published on September 11th, 2025

Your wildfire data can do more than predict where fires may spread.

It can guide the decisions that protect your grid and your communities.

Wildfire threats are rising, regulations are tightening, and budgets are stretched thin. Utilities need more than risk maps, they need investment strategies that deliver lasting resilience.

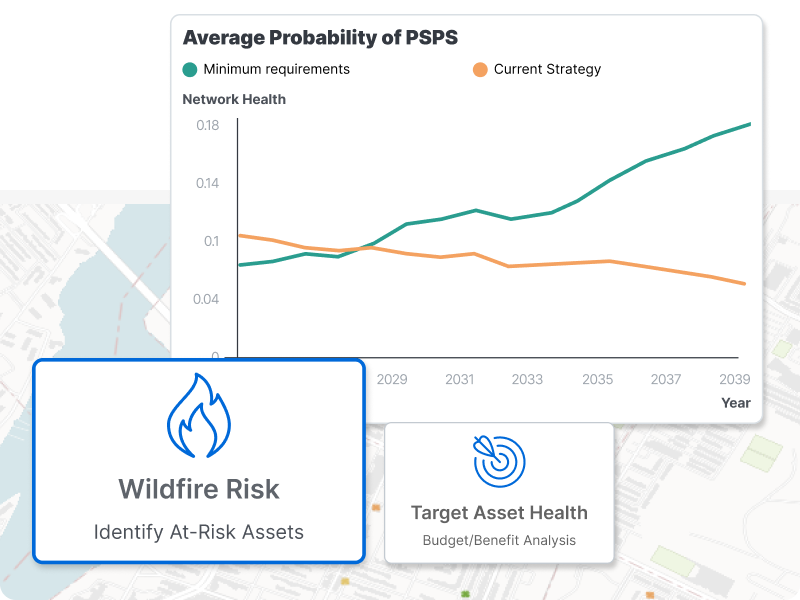

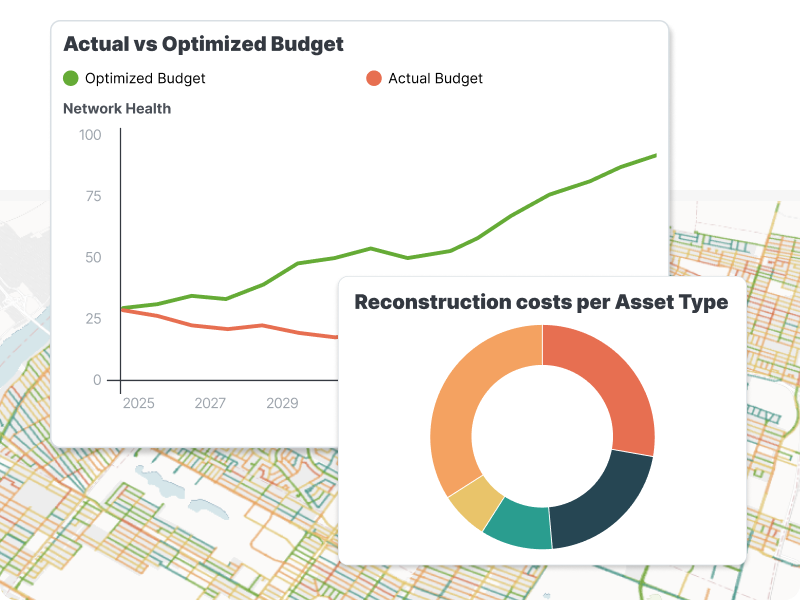

This guide shows your wildfire data can help you:

- Understand the financial impacts of potential failures

- Identify infrastructure and assets are at risk

- Compare mitigation strategies to maximize the value of every dollar spent

Complete the form to download the guide and learn how wildfire data can be transformed into strategic investment planning.

Our Solutions

Every utility’s wildfire and investment planning challenges are different.

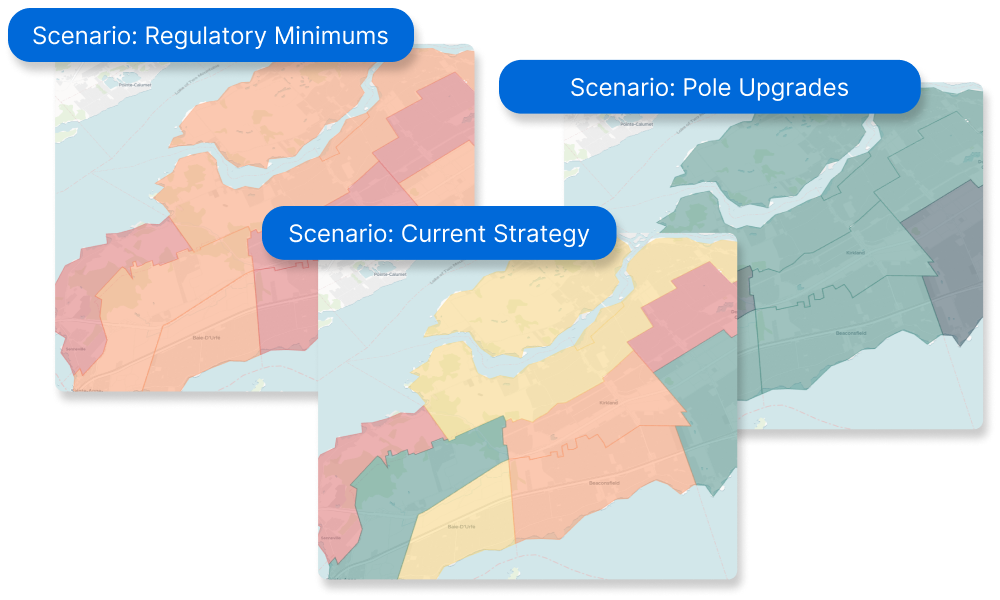

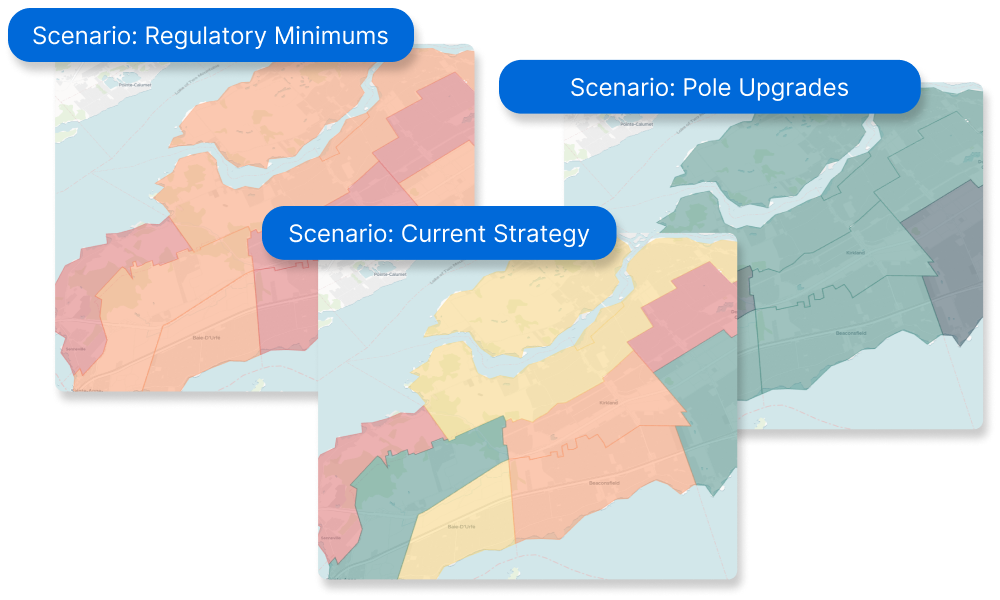

That’s why DIREXYON offers two flexible solutions: DIREXYON GO for fast, out-of-the-box data visualization and simulation, and DIREXYON Enterprise for organizations that need a fully configurable, What-If scenario simulation.

DIREXYON GO

Leverage AI to complete your data and run out-of-the-box wildfire and investment simulations.

DIREXYON Enterprise

Configure complex models and run advanced What-If simulations tailored to your network.

Reducing Wildfire Risk with Direxyon

In California, utilities must comply with the state’s Wildfire Mitigation Plan (WMP) regulation, which requires them to demonstrate how their investments reduce wildfire risk and protect communities. This means balancing safety, reliability, compliance, and cost in a highly scrutinized environment.

BVES and Liberty Utilities are two examples of electric utilities who take

Bear Valley Electric Service

“The outcomes from the DIREXYON tool empowers BVES with a comprehensive understanding

of network conditions, enabling proactive risk management and informed decision-making for a

more resilient and secure energy infrastructure. “

Liberty Utilities

“With the Direxyon tool, Liberty will be able to assess each circuit at the segment level to target riskier areas of its system effectively. By utilizing risk output metrics…Liberty will be able to identify asset types where specific risk reduction mitigation can be performed to reduce overall risk.”

Let us show you how it works

Our product specialists will walk you through our proven approach to enhance your capital investment planning.

Explore resources

-

News

NewsDIREXYON Launches GO, an AI-Powered Platform to Streamline Strategic Infrastructure Investments

Read more : DIREXYON Launches GO, an AI-Powered Platform to Streamline Strategic Infrastructure InvestmentsSelf-serve Digital Twin delivers clarity to strategic infrastructure decisions Montreal, QC, September 18, 2025 – DIREXYON Technologies today announced the launch of DIREXYON GO, a self-serve platform that simplifies and accelerates Asset Investment Planning (AIP) for municipalities and utilities. DIREXYON…

-

Blog

BlogWhat is Strategic Asset Management?

Read more : What is Strategic Asset Management?Strategic Asset Management is more than a buzzword. It’s a transformative shift in how municipalities and electric utilities manage infrastructure, budgets, and long-term risk. At its core, strategic asset management is about using data to make better decisions. Instead of…

-

Blog

BlogMaking Every Dollar Count with Capital Planning Software

Read more : Making Every Dollar Count with Capital Planning SoftwareIf you’re still using spreadsheets to manage long-term infrastructure investments, you’re not alone, but you’re probably struggling. Traditional capital planning is often fragmented across departments, reliant on manual tools, and focused on short-term priorities. Asset managers may plan in isolation…