Making Every Dollar Count with Capital Planning Software

Published on August 4th, 2025

If you’re still using spreadsheets to manage long-term infrastructure investments, you’re not alone, but you’re probably struggling.

Traditional capital planning is often fragmented across departments, reliant on manual tools, and focused on short-term priorities. Asset managers may plan in isolation from finance teams. Critical infrastructure renewal projects get postponed year after year due to budget uncertainty. And long-term consequences, like mounting maintenance backlogs or service disruptions, are frequently overlooked.

The result? Deferred maintenance, funding gaps, reactive spending, and lost value. Without a unified, forward-looking approach, it’s nearly impossible to make smart, sustainable capital investment decisions.

That’s where capital planning software comes in.

What is capital planning software?

Capital planning software is a purpose-built tool that helps organizations model, prioritize, and optimize long-term investments in infrastructure. It replaces static spreadsheets with dynamic simulations, providing clarity into how today’s decisions impact tomorrow’s performance, cost, and risk.

More than just a digital budget worksheet, capital planning software enables:

- Lifecycle thinking: Considering the full cost and impact of assets over time

- Scenario modeling: Answering “what if?” questions before budgets are finalized

- ROI-driven planning: Ensuring investments align with long-term value and performance goals

By combining technical asset data with financial modeling, these platforms help public and private sector organizations make data-driven, strategic, and transparent capital decisions.

Core capabilities of capital planning software

What does effective capital planning software actually do? The most advanced platforms offer features that go far beyond traditional planning tools:

- Multi-Year Investment Planning: Plan 10, 20, or even 50 years into the future to understand funding needs and infrastructure outcomes over time.

- Scenario Analysis: Evaluate what happens under different funding levels, risk thresholds, or policy directions. For example: What if your budget is cut by 15%? What if you prioritize resiliency instead of cost?

- Cost-Benefit Prioritization: Rank and select investments based on ROI, asset condition, service impact, or risk exposure.

- Risk-Based Modeling: Incorporate asset failure probabilities, consequence of failure, and criticality to align investments with organizational risk tolerance.

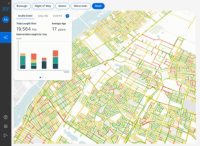

- Integration with GIS and Inventory: Import asset data from systems like CMMS, EAM, or GIS to ground planning in current inventory and condition.

- Dashboards and Reports: Generate board-ready reports and interactive dashboards that clearly communicate trade-offs, trends, and recommendations.

These capabilities allow organizations to transition from reactive to proactive capital planning and to adapt quickly when funding levels or priorities change.

Who uses capital planning software?

Capital planning software is used by a wide range of asset-intensive organizations:

- Local Governments: City and regional governments use it to plan long-term infrastructure investments across roads, parks, water systems, and public buildings.

- Utilities: Electric, water, and wastewater utilities apply capital planning tools to manage network upgrades, renewals, and regulatory compliance.

- Transportation Agencies: Transit and transportation departments rely on it to assess system-wide needs, reduce lifecycle costs, and improve reliability.

- Facilities Teams: Hospitals, school boards, universities, and other large facility owners use it to manage building portfolios and ensure long-term serviceability.

Whether you oversee a $20 million or $2 billion asset portfolio, the need is the same: get the right investments to the right assets at the right time — and justify those decisions clearly.

Benefits of capital planning software

The value of capital planning software goes beyond better interfaces for long-term planning, it improves outcomes across the organization:

- Informed, Transparent Decisions: Make decisions based on evidence, not intuition, and explain them to stakeholders with confidence.

- Deferred Costs and Risks Made Visible: Clearly see the long-term impacts of postponing critical investments, helping you avoid surprise failures or reactive spending.

- Alignment Across Stakeholders: Bring engineering, finance, and leadership teams together around shared assumptions, forecasts, and goals.

- Improved Resilience and Service Delivery: Prioritize investments that improve system performance, reduce risk, and enhance public trust.

In a world of limited budgets and aging infrastructure, these benefits can make the difference between maintaining service — and scrambling to catch up.

What to look for in capital planning software

Not all capital planning tools are created equal. When evaluating your options, consider these must-have features:

- Asset-Level Detail with Portfolio-Level Rollup: Ability to drill down to individual assets or projects while also seeing system-wide performance.

- User-Friendly Scenario Creation: Stakeholders should be able to model new funding strategies or priorities without writing code.

- Integration with Condition Assessments and Financial Systems: Data agnostic capital planning tools that can integrate with existing systems improves accuracy and reduces manual errors.

- Cloud-Based Collaboration and Auditability: Multiple departments can work together in a single platform — with tracked changes, user roles, and transparent assumptions.

A modern capital planning platform should make your job easier — not more complicated.

Take the next step toward smarter planning

Capital planning doesn’t need to be a reactive, manual, and frustrating process. With the right software, you can turn infrastructure data into investment strategy — and long-term risk into confident decision-making.

DIREXYON’s Asset Investment Planning software helps organizations model investments, simulate long-term outcomes, and prioritize projects based on cost, risk, and performance.

Trusted by cities, utilities, and infrastructure owners across North America, it’s designed to support transparency, sustainability, and stakeholder confidence.

Discover a smarter, data-driven way to manage your infrastructure

Let us show you how it works

Our product specialists will walk you through our proven approach to enhance your capital investment planning.

Explore resources

-

News

NewsDIREXYON Launches GO, an AI-Powered Platform to Streamline Strategic Infrastructure Investments

Read more : DIREXYON Launches GO, an AI-Powered Platform to Streamline Strategic Infrastructure InvestmentsSelf-serve Digital Twin delivers clarity to strategic infrastructure decisions Montreal, QC, September 18, 2025 – DIREXYON Technologies today announced the launch of DIREXYON GO, a self-serve platform that simplifies and accelerates Asset Investment Planning (AIP) for municipalities and utilities. DIREXYON…

-

E-book

E-bookTurning Wildfire Data into Smarter Investments

Read more : Turning Wildfire Data into Smarter InvestmentsYour wildfire data can do more than predict where fires may spread. It can guide the decisions that protect your grid and your communities. Wildfire threats are rising, regulations are tightening, and budgets are stretched thin. Utilities need more than…

-

Blog

BlogWhat is Strategic Asset Management?

Read more : What is Strategic Asset Management?Strategic Asset Management is more than a buzzword. It’s a transformative shift in how municipalities and electric utilities manage infrastructure, budgets, and long-term risk. At its core, strategic asset management is about using data to make better decisions. Instead of…