Hydro-Québec TransÉnergie Success Story

Published on September 1st, 2021

PROJECT SUMMARY

Despite an aging asset portfolio, Hydro-Québec TransÉnergie

(HQT) must maintain service levels at the lowest possible cost

– requiring the organization to take the right actions at the

right time and find the right balance between equipment profitability, assumed risk and resource investments. Using the

DIREXYON modeling tool, HQT asset managers anticipate issues

associated with an aging transmission network, while making

the right strategic asset investment decisions.

- Over 4 million clients

- Nearly 40 asset types

- Over 800,000 individual assets

- Nearly 35,000 km / 22,000 miles

of high-voltage power lines - Over 500 substations

- Assets valued at over $20B

“An asset-focused approach that considers the complete lifecycle of each component

addresses the division’s strategic requirements and anticipates future needs in order

to achieve and maintain the desired performance.”– Marie-Josée Roby, Hydro-Québec TransÉnergie

BACKGROUND

Hydro-Québec TransÉnergie (HQT) manages one of

North America’s most extensive electric power transmission systems, serving local populations and supplying

power to three Canadian provinces and four U.S.

States. Every year, HQT invests over $2B to maintain

its network and ensure its sustainability.

The organization must show its shareholder that, even

with an aging asset portfolio, its strategies deliver

network reliability at the lowest cost, and can be

implemented despite a shortage of qualified labour.

Based on their role within the network, assets must

meet certain standards that influence inspection,

maintenance and turnover strategies and costs. In

addition, when evaluating annual rate adjustment

requests, regulatory authorities demand exemplary

rigour, with results based on science and data.

RESULTS

-

- Now, Hydro-Québec TransÉnergie can identify the

-

- OPEX and CAPEX strategies that offer the best return

-

- on assets, while meeting required service levels and

-

- controlling risks. Thanks to the DIREXYON platform,

- the organization is equipped to easily and quickly:

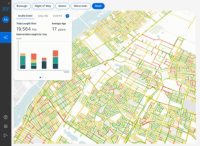

- Determine optimal intervention sequencing strategies (i.e., maintenance, repair/refurb, replacement)

and the best policies to prioritize maintenance and

investments - Generate strategic maintenance and investment

plans to make sure impacts of short-term decisions

are evaluated in the long term - Analyze the consequences of CAPEX and OPEX

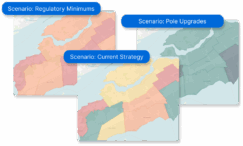

budget increases or cuts on risk and key performance indicators in the short, medium and long term - Develop conclusive scenarios to guide strategic

decision-making - Document the internal asset management

expertise using clear and intuitive models

CHALLENGES

Hydro-Québec TransÉnergie used its asset management expertise to develop several sophisticated

models to create, test and validate predictive trends

for sustainability and adaptive maintenance.

However, the systems available on the market were

not scaled to handle the huge volume of assets and

calculations required to fully simulate the portfolio’s

evolution over a 50-year period. In this context, standard modeling tools (i.e., Excel, MATLAB, Python, etc.)

were too limiting.

When working with a group of experts, the goal is to

instill a collaborative environment that lets each of

them contribute to projects. With this in mind, HQT

was looking for a centralized approach to formalize

its asset investment decision policies.

OUR SOLUTION

The DIREXYON platform is recognized by HydroQuébec TransÉnergie as a strategic, transparent

and proven tool to make the right organizationwide decisions in order to reach optimal reliability,

cost efficiency, risk management and governance.

The platform allows users to divide the network into

different asset categories, where each one is individually modelled using only “drag & drop” functionalities.

Not a single line of programming code is required.

The organization is empowered to independently

maintain and sustain the solution.

The DIREXYON platform also generates realistic

maintenance and investment scenarios at the lowest

possible cost, giving the organization’s internal

experts a clear picture of the relationship between

asset management policies, revenue requirements,

long-term performance and network reliability risks.

Internal expertise is digitized through the configuration

of intuitive decision trees, which all stakeholders

easily understand, assess and enhance.

Furthermore, numerous technical reports are now

automated.

Finally, because all simulation data is saved, the

platform is designed to meticulously reconstruct and

audit all calculations.

KEY REQUIREMENTS

To maintain required levels of service and simultaneously manage both cost and risk, while meeting all

stakeholder requirements, the solution must:

- Systematically test asset inspection, maintenance

and renewal policies - Produce reports that allow users to make short-,

medium- and long-term projections for service

levels and key indicators throughout the network,

based on different scenarios - Integrate risk and asset degradation evaluation

models, as well as all intervention policies, for each

asset category - Integrate sophisticated work synchronization rules to

generate realistic forecasts on upcoming projects - Optimize investment and maintenance strategies,

and adapt them to asset aging considerations

based on multiple factors (i.e., risk, return, service

level, budget, etc.) - Generate a model to rigorously quantify the strategy’s impact on user rates, so these rates can then

be justified to regulatory authorities

Let us show you how it works

Our product specialists will walk you through our proven approach to enhance your capital investment planning.

Explore resources

-

News

NewsDIREXYON Launches GO, an AI-Powered Platform to Streamline Strategic Infrastructure Investments

Read more : DIREXYON Launches GO, an AI-Powered Platform to Streamline Strategic Infrastructure InvestmentsSelf-serve Digital Twin delivers clarity to strategic infrastructure decisions Montreal, QC, September 18, 2025 – DIREXYON Technologies today announced the launch of DIREXYON GO, a self-serve platform that simplifies and accelerates Asset Investment Planning (AIP) for municipalities and utilities. DIREXYON…

-

E-book

E-bookTurning Wildfire Data into Smarter Investments

Read more : Turning Wildfire Data into Smarter InvestmentsYour wildfire data can do more than predict where fires may spread. It can guide the decisions that protect your grid and your communities. Wildfire threats are rising, regulations are tightening, and budgets are stretched thin. Utilities need more than…

-

Blog

BlogWhat is Strategic Asset Management?

Read more : What is Strategic Asset Management?Strategic Asset Management is more than a buzzword. It’s a transformative shift in how municipalities and electric utilities manage infrastructure, budgets, and long-term risk. At its core, strategic asset management is about using data to make better decisions. Instead of…