Power grid planning for 2023 and beyond

Published on January 20th, 2023

Over the next decade, the electric utility ecosystem is perfectly poised to grow its potential, along with its complexity. From rising interest rates to regulatory constraints, and continuously evolving priorities, utilities face difficult budgetary decisions in tandem with mounting pressure to increase adoption of renewable generation. How can more be done, with less?

To ensure that your critical asset infrastructure is sustainable and adaptable on both a physical and financial level, continued leveraging of your organization’s expertise and vision is critical. Ultimately, your organization needs a plan that can carry you smoothly from 2023 on into 2035—the key net-zero milestone. But making wise and timely decisions can be deceptively straightforward.

In the spirit of solidly well-informed plans, consider the following key elements of successful power grid planning:

1. Managing the modernization of long-term strategic assets

To improve performance and reduce downtime, utilities need to upgrade and optimize their aging grid infrastructure. This means implementing smart grid technology that helps utilities better manage energy supply and demand and integrating renewable resources to reduce their reliance on fossil fuels and decrease carbon emissions.

But budgets rarely allow for mass replacements of old equipment with new, more efficient devices, that incorporate modern technologies. So, choices must be made, and upgrades prioritized.

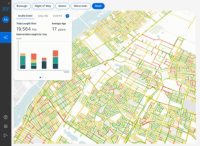

The most profitable decisions you’re likely to make in the name of sustainable asset lifecycle management can be readily facilitated and accelerated using Asset Investment Planning (AIP) technology, which makes it possible to gain insight into your grid’s future needs via:

- Predictive analytics: AIP offers predictive analytics for CAPEX/OPEX optimization amid challenges involving resource limitations and aging infrastructures. Harnessing a range of financial modeling techniques to uncover patterns in your data, AIP software can identify upcoming risks and opportunities alike.

- ‘What-if scenario’ modeling: More and more senior executives are starting to turn towards AIP software to gain a better understanding of the risks they face, so they can competently prepare for the future. By undertaking a ‘what-if scenario’ analysis, they’re able to factor elements like government policy changes or shadow pricing into their calculations.

- Machine learning: Power utilities can use data analytics and machine learning algorithms to analyze grid data and optimize energy supply and demand. This includes predicting demand patterns, identifying energy losses, and optimizing grid operations to reduce costs and improve efficiency.

2. Integrating Distributed Energy Resources (DERs)

Energy systems with any hope of thriving in the future will need to prioritize distributed generation, so preparing for its rise is everything.

Common examples of DERs include rooftop solar PV units, natural gas turbines, microturbines, wind turbines, biomass generators, fuel cells, tri-generation units, battery storage, and electric vehicles (EV).

The EV industry is currently valued at $287.36 billion. That’s an increase of about $40 billion since 2020, and this figure is set to surpass $1.3 trillion by 2028. The industry is growing exponentially, and consumer interest is nowhere near its peak. Utilities need to be prepared.

DERs represent unique challenges for electric utilities. Their rise poses a significant challenge, especially around unplanned for infrastructure investments as consumers shift towards prosumers.

But they can also be a key element on a path towards resiliency. If utilities adopt energy storage solutions now, they can help them manage peak demand periods and provide backup power during outages. These solutions can also support the integration of renewable energy sources by storing excess energy for use when demand is high.

The use of AIP technologies can help to weigh the impacts and trade-offs associated with the challenges of DERs to help utility leaders clarify current opportunities, helping organizations to achieve their goals.

3. Weighing internal demand

With a well-informed, value-based decision-making approach, your organization can ensure it is making the right grid modernization investments at the right time.

Weighing demand internally is a good place to start. Calculating the value of your utility electrifying its car fleet, for instance. Be sure to factor in: model implementation costs, maintenance costs, and TCO (total cost of ownership) to develop a clear picture of the point at which electric vehicles become the better choice for you over cars powered by gasoline.

Imagine how much simpler it would be if you could digitize the internal expertise of your infrastructure managers, including the modeling of an asset’s evolution and decision-making processes over time.

4. Weighing external demand

If you’re able to foresee and calculate excess charges on your network, you’re that much more likely to be able to anticipate cases of accelerated degradation of your assets or infrastructure in certain areas or ‘pockets.’ By extension, you’ll be better equipped to predict and prepare for the impact this may have on your network.

Hydro-Quebec TransEnergie, operator of North America’s most extensive electrical power transmission system with assets valued over $20 billion, implemented an AIP solution to better anticipate issues that might arise due to an aging network. With the application of the software, they determined the optimal intervention sequencing strategies and the best policies for prioritizing maintenance and investments.

Looking beyond 2023

In a world driven by grid modernization and net-zero targets, planning for your network’s future needs today is crucial to its survival. Overall, modernizing power grids requires a comprehensive approach that incorporates new technologies, renewable energy sources, and advanced analytics to optimize grid performance and reliability while reducing costs and carbon emissions.

Utilities have always had to work around factors that are beyond their control, but with data analysis and optimized capital planning software, you can now foresee any possible risk, and have strategies at the ready to identify, analyze and mitigate that risk. Ensuring that your utility provides the most reliable, affordable, accessible and safe energy for decades to come.

Looking to the future

Let us show you how it works

Our product specialists will walk you through our proven approach to enhance your capital investment planning.

Explore resources

-

News

NewsDIREXYON Launches GO, an AI-Powered Platform to Streamline Strategic Infrastructure Investments

Read more : DIREXYON Launches GO, an AI-Powered Platform to Streamline Strategic Infrastructure InvestmentsSelf-serve Digital Twin delivers clarity to strategic infrastructure decisions Montreal, QC, September 18, 2025 – DIREXYON Technologies today announced the launch of DIREXYON GO, a self-serve platform that simplifies and accelerates Asset Investment Planning (AIP) for municipalities and utilities. DIREXYON…

-

E-book

E-bookTurning Wildfire Data into Smarter Investments

Read more : Turning Wildfire Data into Smarter InvestmentsYour wildfire data can do more than predict where fires may spread. It can guide the decisions that protect your grid and your communities. Wildfire threats are rising, regulations are tightening, and budgets are stretched thin. Utilities need more than…

-

Blog

BlogWhat is Strategic Asset Management?

Read more : What is Strategic Asset Management?Strategic Asset Management is more than a buzzword. It’s a transformative shift in how municipalities and electric utilities manage infrastructure, budgets, and long-term risk. At its core, strategic asset management is about using data to make better decisions. Instead of…