How electric utilities can optimize vegetation management

Published on June 19th, 2024

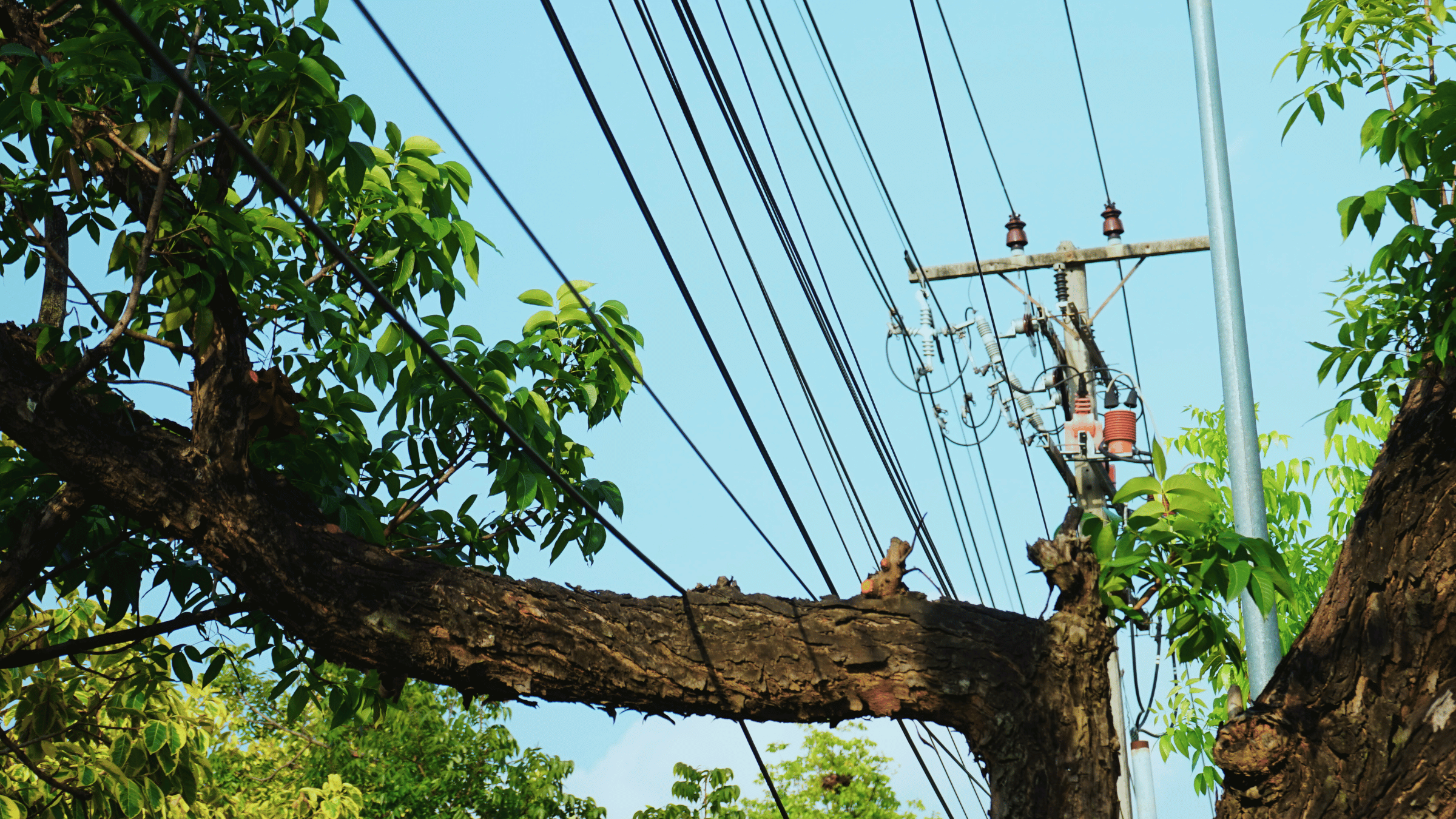

Vegetation management has always been one of the costliest line items in an electric utility’s budget.

Utilities invest billions of dollars annually on vegetation management because trees falling on power lines is one of the biggest disruptors of service. And in dry conditions, vegetation coming into contact with electrical assets can spark wildfires.

Despite its pivotal role in safety and reliability, vegetation management remains a largely inefficient process. So, what can electric utilities do to optimize vegetation management?

Table of Contents

Traditional vegetation management

The standard vegetation management strategy utilities employ is cycle-based.

Cycle-based vegetation management sees utilities deploying crews across different parts of their service territory to rim and cut.

Emergency work is conducted to address any immediate risks. But otherwise the work is conducted on a set schedule, trimming different areas every year.

And while this method has clearly been effective, it doesn’t take into account the actual risk to infrastructure and assets.

Complicating matters further is that rising temperature and longer growing season can affect the way vegetation grows. Or, like in the event of droughts, can undermine a tree’s health.

By blindly following the cycle, utilities risk spending years without managing the vegetation that poses the greatest risk.

Risk-based vegetation management

Rather than continue to conduct cycle-based vegetation management, electric utilities must consider switching to risk-based vegetation management.

This optimizes the investment by predicting and prioritizing:

- At risk assets

- At risk vegetation

Knowing which assets are most likely to fail and which areas of vegetation are the riskiest can be difficult to assess without the right tools.

Which is why an Asset Investment Planning (AIP) solution is essential for optimizing a vegetation management strategy.

Optimizing vegetation management with AIP

Asset Investment Planning (AIP) is a type of asset management software that enables organizations to strategically plan around their assets and investments.

By combining complex data sets, predictive modeling, decision-making policies, and simulation, AIP lets organizations see the potential outcomes of different investment scenarios, ensuring informed, long-term decisions.

The process is as follows:

Data

As with any strategic optimization with AIP, vegetation management begins at the data level. The data you’ll need includes:

- Vegetation data. Species growth rates, canopy heights, etc.

- Asset data. Condition, age, dimensions, criticality, maintenance history.

- Geospatial data. Locations of assets.

- Weather data.Temperature, precipitation, wind speed, wildfire spread probabilities.

- Financial data. Cost of labor, materials, budget projections.

- Risk data. Consequence of failure, probability of failure, outage history.

Of course, if not all this data is available, the AIP can leverage machine learning to fill in any gaps.

Predictive models then take this data and forecast asset performance, potential failures, vegetation growth, and risk probability.

Decision Twin

Since investing, risk, and decision-making is equal parts science and art, the AIP must also be able to consider the human element in its simulations. Which is why Direxyon’s AIP leverages what is known as a “Decision Twin.”

Decision Twins are a series of decision-trees configured and customized by an organization’s subject matter experts. As a result, the AIP not only relies on data but also the nuanced, experienced-based decisions experts make in real-world scenarios.

Simulation and scenario modeling

With the data, predictive models, and Decision Twins in place, AIP users can begin to simulate how their assets, investments, and decisions evolve over time.

This comprehensive approach allows them to explore various scenarios, optimize their strategies, and make informed decisions that align with their long-term goals.

Specifically for vegetation management strategies, electric utilities can model scenarios to answer questions like:

- What if we want to reduce our risk by 30% in the next ten years?

- What if we prioritize high fire risk areas regardless asset age or condition?

- What if we prioritize faster growing species?

These “What If” questions are scenarios to model. And each investment scenario modeled will deliver new insight.

When comparing investment scenarios, the utility may find that a combination of targeting high-risk assets network-wide and specific high-fire risk areas makes the most sense from financial, regulatory, risk mitigation, and asset health perspective.

Ultimately, finding the ideal balance and making informed decisions by continuously evaluating asset performance and risk ensures the investment in vegetation management is having the intended effect.

Test your risk-based vegetation management strategies with Direxyon

Given the role vegetation plays in wildfires, power outages, and asset failures, relying solely on reactive planning is too risky. And because electric utilities must juggle disparate information like plant species data, weather patterns, government regulations, and more, relying on risk-based predictive analytics and decision-modeling exponentially increases the efficiency of targeting the biggest risks.

Solutions like DIREXYON’s Asset Investment Planning Suite can help utilities navigate the uncertainties and geo-specific constraints of vegetation management. Creating a more reliable, secure grid begins with vegetation management supported by risk-based predictive analytics.

Optimize your vegetation management

Find out how Direxyon’s asset, vegetation, and risk models can optimize your investment in safety and reliability.

Book a Demo

Let us show you how it works

Our product specialists will walk you through our proven approach to enhance your capital investment planning.

Explore resources

-

News

NewsDIREXYON Launches GO, an AI-Powered Platform to Streamline Strategic Infrastructure Investments

Read more : DIREXYON Launches GO, an AI-Powered Platform to Streamline Strategic Infrastructure InvestmentsSelf-serve Digital Twin delivers clarity to strategic infrastructure decisions Montreal, QC, September 18, 2025 – DIREXYON Technologies today announced the launch of DIREXYON GO, a self-serve platform that simplifies and accelerates Asset Investment Planning (AIP) for municipalities and utilities. DIREXYON…

-

E-book

E-bookTurning Wildfire Data into Smarter Investments

Read more : Turning Wildfire Data into Smarter InvestmentsYour wildfire data can do more than predict where fires may spread. It can guide the decisions that protect your grid and your communities. Wildfire threats are rising, regulations are tightening, and budgets are stretched thin. Utilities need more than…

-

Blog

BlogWhat is Strategic Asset Management?

Read more : What is Strategic Asset Management?Strategic Asset Management is more than a buzzword. It’s a transformative shift in how municipalities and electric utilities manage infrastructure, budgets, and long-term risk. At its core, strategic asset management is about using data to make better decisions. Instead of…